Investing in technology: Opportunities and Risks

The tech industry has experienced rapid growth in recent decades, presenting a diverse range of potential investment opportunities ranging from hardware and software to internet and mobile technology. Investing in technology has been at the forefront of public debate in recent months, particularly in light of the volatility in tech stocks in the past 12 months. Although technology may appear to be a great investment and promising financial decision, it is necessary to fully consider both the opportunities and risks that these types of investments entail, before making a decision.

Opportunities

1-Growth potential. The tech industry is one of the fastest-growing and most dynamic sectors of the economy. This sector has the potential to generate high returns due to its rapid growth and horizontal and vertical expansions. Consider some of the most famous examples:

a. Apple. Apple began by selling kit computers to hobbyists in a small garage, but it now designs, develops, and sells a wide range of consumer electronics, computer software, and online services around the world, making it one of the most valuable companies in the world with a market cap of USD 2,4 trillion (as of February 2023)[1].

b. Amazon. Amazon has evolved from simply selling books at the end of the 1990s to a multinational technology company with a substantial market share in e-commerce, cloud computing, digital streaming, and artificially intelligent devices such as Alexa.

c. Alphabet (Google). Alphabet, which started as a search engine, now dominates online advertising (28% of net digital advertising revenue in 2022)[2] and has a strong foothold in cloud computing, mobile phone operating systems, video streaming, maps and mobility, and many other areas.

d.Microsoft. Microsoft, which started by writing a BASIC interpreter for Altair 8800 as their first product, is now a multinational technology corporation specializing in computer software, consumer electronics, and cloud computing services. Microsoft has the potential for continued growth and increased market share due to its strong market position and growing focus on cloud computing (21% share in Q3 2022)[3] and artificial intelligence.

2-Diversification. Investments in technology can help mitigate risk, diversify portfolios, and potentially increase returns. Investing in a mix of tech companies across different product offerings and technology trends minimizes the risks associated with investing in just one company or trend. Tech investors can approach diversification in several ways:

a-Hardware vs software. Investing in both hardware and software provides product diversification and revenue streams. A portfolio with at least some investments focusing on the hardware side of the spectrum as well as others focusing solely on software has a lower risk of missing out on major developments that may occur on one of the sides.

b-Mobile vs Virtual Reality. The same idea applies here: while some predict that mobile will continue to dominate, others predict that the trend of mobile technologies largely replacing desktop computing over the last decade will repeat, with VR driving out mobile soon. Either way, investing in both technologies in this case could provide valuable diversification.

3-Innovation. Investing in technology provides access to completely new products, services, or processes in an industry. This can be accomplished through a variety of channels, including:

a-Disruptive technologies. Investors in Tesla (disrupted electric vehicles, electricity storage, and solar roof verticals ) or Block (formerly Square, disrupted mobile payments) benefited immensely as these companies disrupted traditional industries.

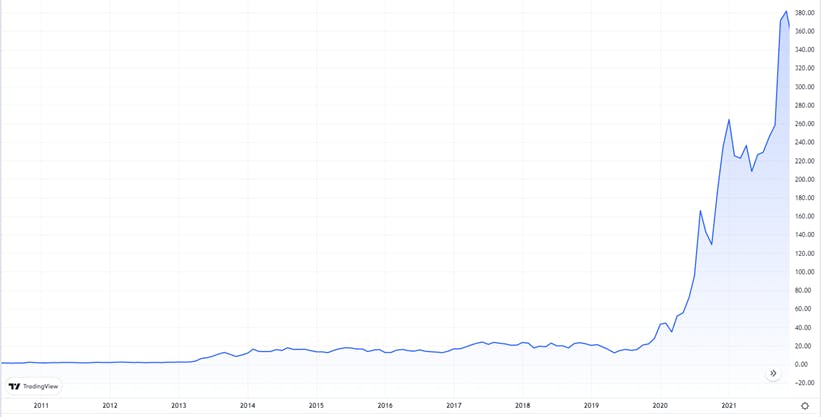

Tesla share price:

Block (formerly square) share price:

b-Emerging trends. Observing the Covid outbreak in China, investors who predicted what would happen and invested in Zoom (videoconferencing) or Delivery Hero (food delivery) caught a trend early on and benefited greatly.

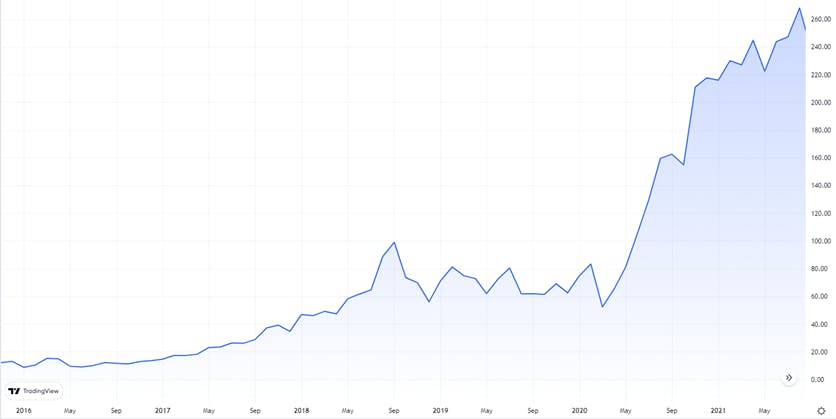

Zoom share price:

Delivery Hero share price:

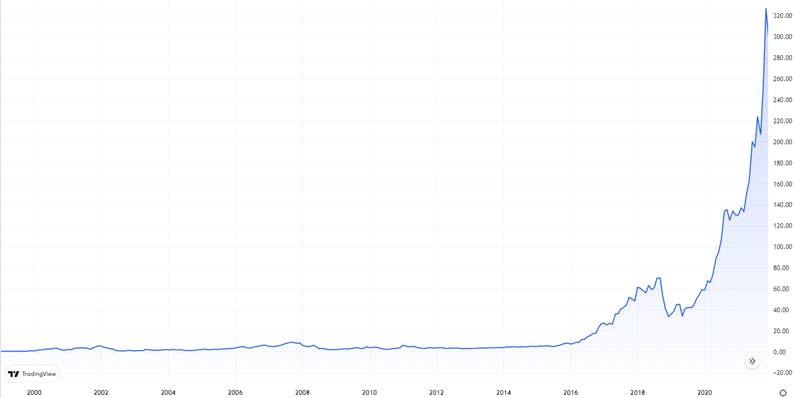

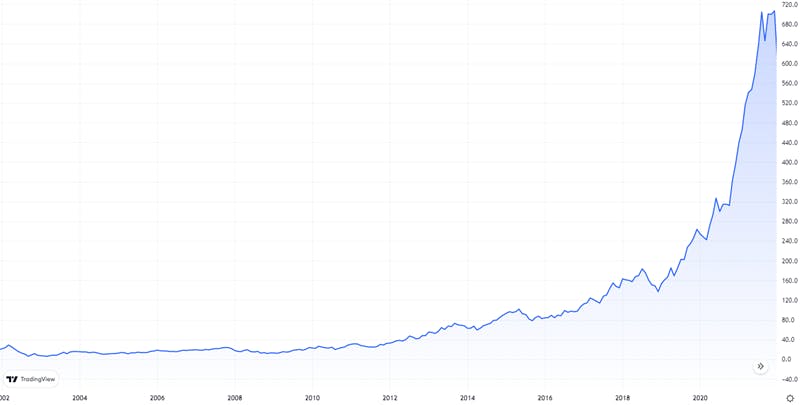

c-Research and development. Investing in companies that spend a lot of money on R&D can pay off big time if those efforts yield a major technological leap in the products. This strategy greatly benefited investors in NVIDIA (graphics processing units) and ASML (photolithography equipment).

NVIDIA Share Price:

ASML Share Price:

4. Global reach. Global reach refers to a company's ability to expand its market presence and customer base beyond its domestic borders in order to reach a global audience. Many tech companies have a global reach and a large customer base, which can provide investors with stability and the opportunity to capitalize on growth elsewhere.

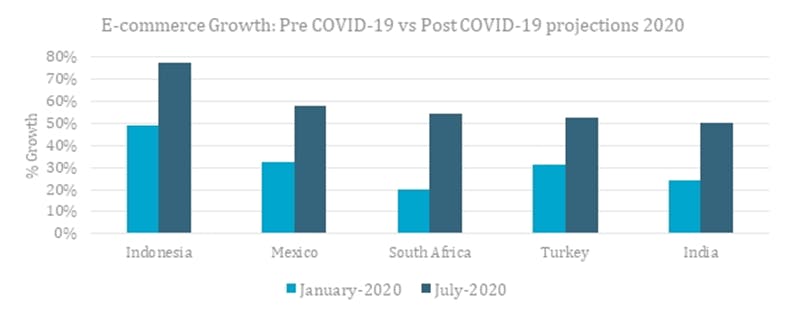

a-E-commerce. Although the rate of growth in e-commerce has slowed in developed markets, emerging markets with lower e-commerce penetration are still growing much faster than the rest of the economy.

E-commerce growth rates of selected developing economies:

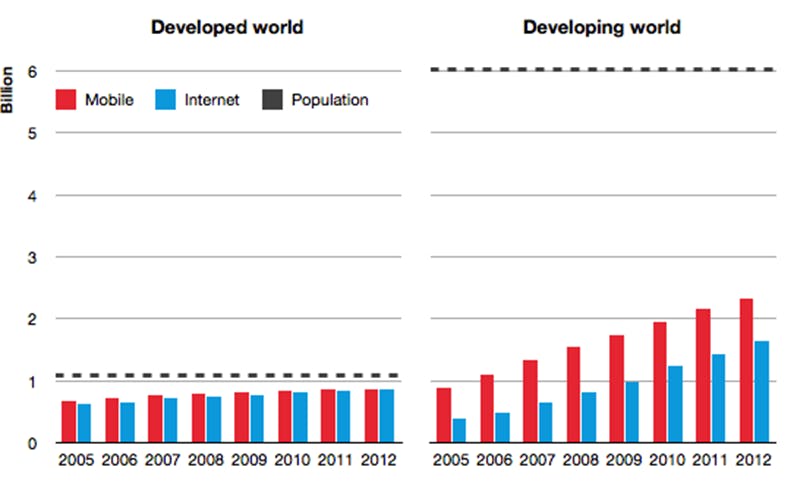

b-Mobile. In developed markets, everyone has a smartphone, so the market is primarily based on replacement and price growth; however, in some emerging markets, smartphone penetration is still increasing dramatically.

Mobile and internet users, developed vs developing world:

Risks

1-Market volatility. The technology sector is frequently subject to high market volatility, which can result in significant fluctuations in investment returns. The dot-com bubble of the late 1990s is a prime example.

S&P500 index between 1997-2004:

2-Competition. The tech industry is highly competitive, and companies are quickly replaced by more innovative competitors.

a-Consider the once-dominant Nokia and Blackberry, which had 51%[4] and 21%[5] market shares in their peak times, respectively, but began to fade with the rise of in the 2010s. Still, Apple's market share never exceeded 29%[6].

b-The other example is Sun Microsystems, once one of Silicon Valley's most promising companies and a proponent of open systems, that was eventually replaced by Open Source due to its inability to monetise its key products and highly competitive environment.

c-In the late 1990s, Netscape Navigator was the most popular internet browser. Seeing the potential in this market, Microsoft, the software company, introduced Internet Explorer, which eventually defeated Navigator due to its ability to provide the browser for free and had a larger audience due to the large number of Microsoft users. However, in the late 2000s, Internet Explorer was defeated in the next browser war by Google Chrome and Safari.

3-Regulatory challenges. The technology industry is subject to a constantly changing regulatory environment, and regulatory changes can have an impact on the success of businesses and investments.

Although many tech companies have a big appetite for expansion, regulators keep putting more and more hurdles in their way, particularly to prevent them from acquiring competitors and other small businesses. Meta, after acquiring Giphy in 2020, was soon required to sell the company by UK regulators who believed the acquisition could reduce competition in the global market. After a lengthy legal battle, the Competition Appeal Tribunal ordered Meta to sell Giphy and pay a fine of 50.5 million pounds for failing to comply with their decision[7].

4-Dependence on key talent. Many technology companies rely heavily on key talent, and the loss of them can have a significant impact on their success. Let us recall Steve Jobs' resignation from Apple in 1985. Until his return in 1997, the company struggled to release products that could compete with everything Jobs launched and was on the verge of bankruptcy. However, with return of Jobs, Apple saw a new wave of success with products such as the iMac, Macbook, iPod, iPhone, and so on.[8]

Conclusion

To summarise, investing in technology can provide remarkable opportunities for growth and financial returns while also posing significant risks. As a form of protection, a potential investor should conduct thorough due diligence ahead of time. When handled with caution, technology investments can be a great complement to a long-term perspective and a well-diversified portfolio, which can help its owner mitigate risks while also increasing chances of success.

[1] https://companiesmarketcap.com/apple/marketcap/

[2] https://www.statista.com/statistics/290629/digital-ad-revenue-share-of-major-ad-selling-companies-worldwide/

[3] https://www.statista.com/chart/18819/worldwide-market-share-of-leading-cloud-infrastructure-service-providers/

[4] https://www.statista.com/statistics/263438/market-share-held-by-nokia-smartphones-since-2007/

[5] https://www.statista.com/chart/8180/blackberrys-smartphone-market-share/

[7] https://www.forbes.com/sites/qai/2022/10/29/meta-giphy-acquisition-uk-regulators-demand-divestment/

[8] https://www.cultofmac.com/445723/today-in-apple-history-steve-jobs-leaves-and-rejoins-apple/